Save yourself from surprises with a pre conversion check

We’ve had clients come to us following a conversion to ask “Why is that in there? It wasn’t in the file I sent to you?”. Well guess what, it was – but it was hidden in history or in reports that are not reviewed. When we’ve shown them where it is it’s been a complete surprise and they have had to deal with it afterwards in Xero.

We’ve had clients come to us following a conversion to ask “Why is that in there? It wasn’t in the file I sent to you?”. Well guess what, it was – but it was hidden in history or in reports that are not reviewed. When we’ve shown them where it is it’s been a complete surprise and they have had to deal with it afterwards in Xero.

Also sometimes you may not have access to that particular software version to do a check of what is in the file, and you certainly don’t want to invest in another program for just one conversion!

The Jet Convert Pre-conversion file check service

Due to this demand we created the Pre-conversion file check service. It is designed to take the stress out of converting a file and ensures that you are comfortable with the data or advised if there is any potential problems. It means that any issues are brought to your attention BEFORE you make the transition into a new accounting package.

So far we have received fantastic reviews for this service and the most common feedback is that clients experience a peace of mind knowing what state the data is in and if there is any additional work recommended before making the leap of faith into a new software.

Let’s be honest learning a new accounting package is daunting in itself and dealing with messy legacy data can contribute to additional strain. Now this does not have to be an issue.

Why should I consider a Pre-conversion file check?

By checking what exists in your file you can avoid headaches afterwards. However there are many other benefits which include:

- Creating a solid foundation on which to build meaningful data in Xero – this can greatly enhance your decision making process.

- Establishing a clean break or clean start by ensuring your data is in good order / condition to convert

- Ensuring a smooth transition for payroll

- You are less likely to miss reporting deadlines for BAS if the transition is smooth

- It enables a proactive approach to potential problems as opposed to time consuming reaction to past problems

- You receive clear, personalised & time-saving instructions on actions required prior to conversion

- You can complete those clean ups of chart of accounts, terminated employees, inactive jobs you have been meaning to do for some time

- It can simplify your accounting process in Xero as you are using clean data

- You also receive helpful suggestions and customised advice on accounting data fixes.

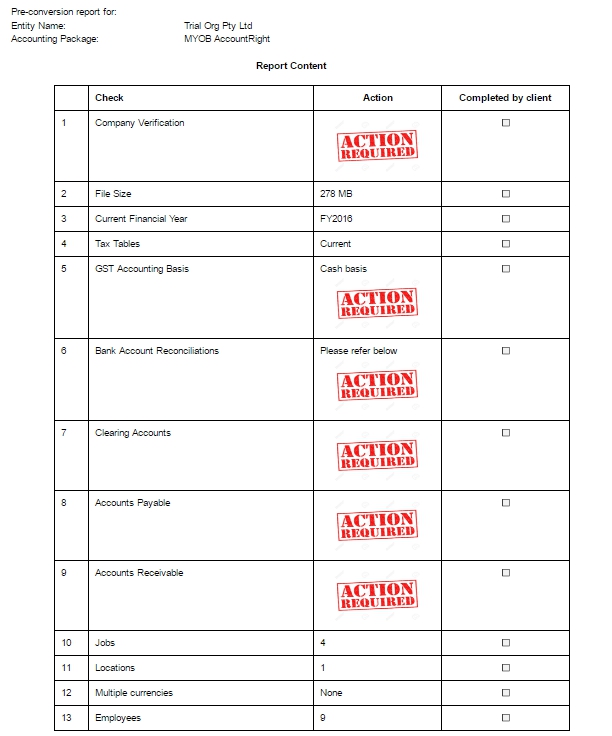

Example pre conversion report

The following is an example of how the report might present. If action is required we provide you with guidance on how to address the issue identified.

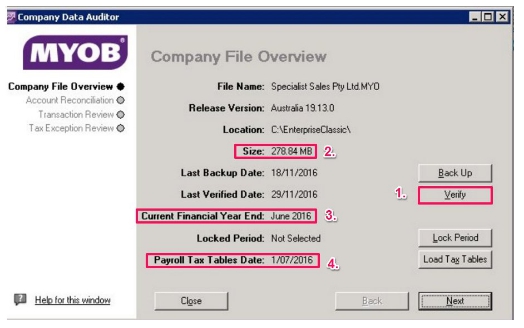

1. Company Verification

Report Items 1-4 shown below:

Verification shows no file errors, FY2016 (transactional data available from 1/7/15).

ACTION REQUIRED BY YOU:

Run a verification on your file before backing it up. In MYOB, File > Verify Company File.

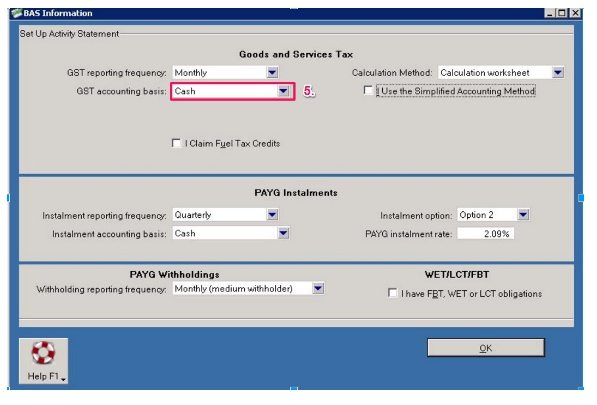

5. GST Accounting Basis

GST Accounting basis for your entity is: CASH

ACTION REQUIRED BY YOU:

If the GST Accounting basis is incorrect update this in the MYOB file prior to conversion.

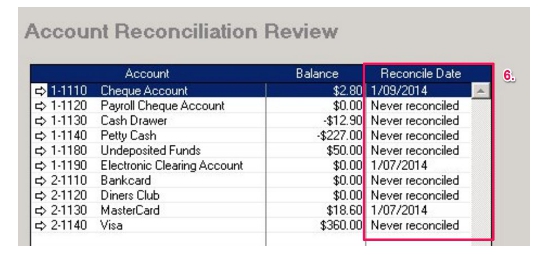

6. Bank Account Reconciliation

Cheque Account, Cash Drawer, Petty Cash and Visa have not be reconciled to current date.

ACTION REQUIRED BY YOU:

We recommend reconciling the bank accounts to the end of quarter or end of the month.

7. Clearing Accounts

There is Undeposited Funds of $50, please refer screen shot under Section 6 above.

ACTION REQUIRED BY YOU:

Both these accounts should be nil before the file is converted. Alternatively please understand why there are balances in this account so you can treat in Xero as appropriate.

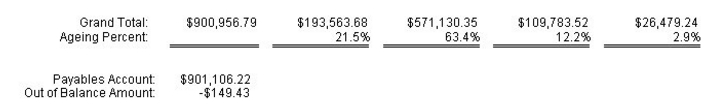

8. Accounts Payable

There is an Accounts Payable ‘out of balance’ of $149.43.

ACTION REQUIRED BY YOU:

Out of balance amount should be nil before conversion. Run a Payables Reconciliation [Detail] report. Please view our helpful blog for advice.

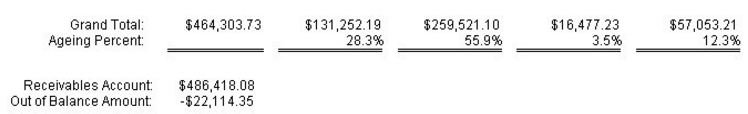

9. Accounts Receivable

There is an Accounts Receivable ‘out of balance’ of $22,114.34.

ACTION REQUIRED BY YOU:

Out of balance amount should be nil before conversion. Run a Receivables Reconciliation [Detail] report. Please view our helpful blog for advice.

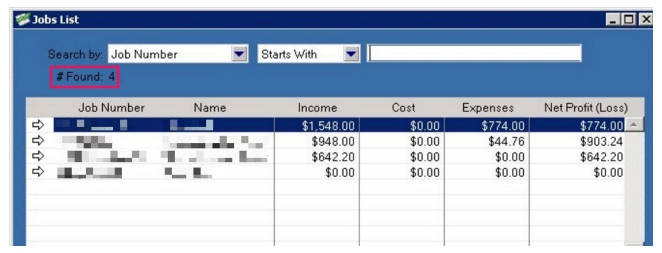

10. Jobs

For MYOB, Jobs and Categories come across in all conversions as long as there are less than 100 of them in the MYOB file. You have 4.

If you need to reduce the jobs please delete active and inactive jobs & categories so they each total less than 100 so this information will convert. Alternatively we can assist for $110, this will only be charged upon successful completion of the conversion.

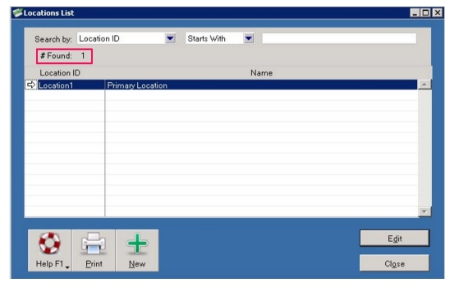

11. Locations

Your entity operates from a single location only.

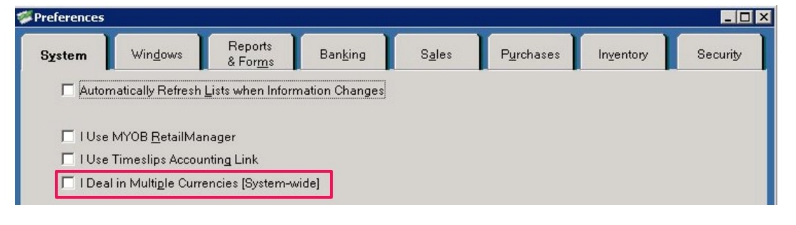

12. Multiple Currencies

Your entity does not deal in multiple currencies.

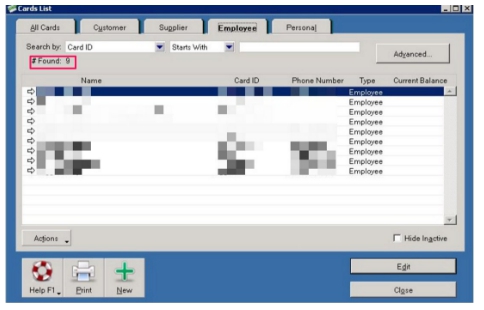

13. Employees

Your entity has 9 employees.

How to order

The pre-conversion file check is fantastic value at $55 if you do not have the tools or time to complete the pre-conversion checks in the data file.

The file checks are completed by one of our conversion data specialists who will review your file and bring to your attention any tasks that should be completed prior to converting your file into Xero. You will receive a comprehensive report on the file and the actions we recommend that you take.

If you are interested in having our conversion experts review your file please upload your file at this link. In the message section please include the description “Pre-conversion check” in addition to any specific questions that you would like answered.

We should be able to respond within 24 hours of receipt during the working week. Once our technical team have reviewed your file and prepared the report you will receive an email with the findings.

Please contact the office on 1800 770 035 if you have any questions or we can assist you further.

Looking forward to hearing from you! Zowie & the Partner Success Team