Xero Tips and Tricks

| SHORTCUT KEY FOR XERO | RESULT |

| Click the Scroller button on the mouse | Opens a link in a new Tab |

| Ctrl Tab | Moves to the next Tab |

| Ctrl Shift Tab | Moves to the previous Tab |

| Ctrl F4 | Closes the current Tab |

| Tab | Moves the cursor to the next input box on the screen |

| Shift Tab | Moves the cursor to the previous input box |

| Alt F4 | Closes the entire browser |

| Esc | The “Escape” button closes any current popup dialog box |

Recode Expenses – Save Time Editing

When expenses are coded to the wrong account, or wrong contact, or with the wrong reference or description fields, the fastest rectification is to “Remove & Redo” the transactions, then code them with “Cash Coding”.

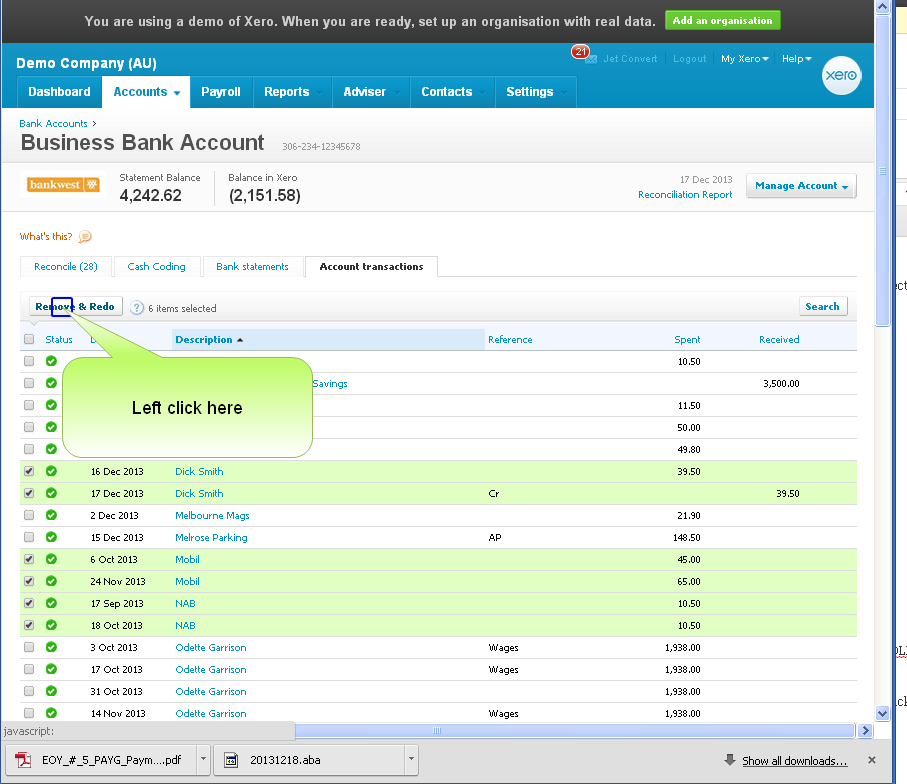

1. Select the transactions which are coded incorrectly, then click “Remove & Redo”.

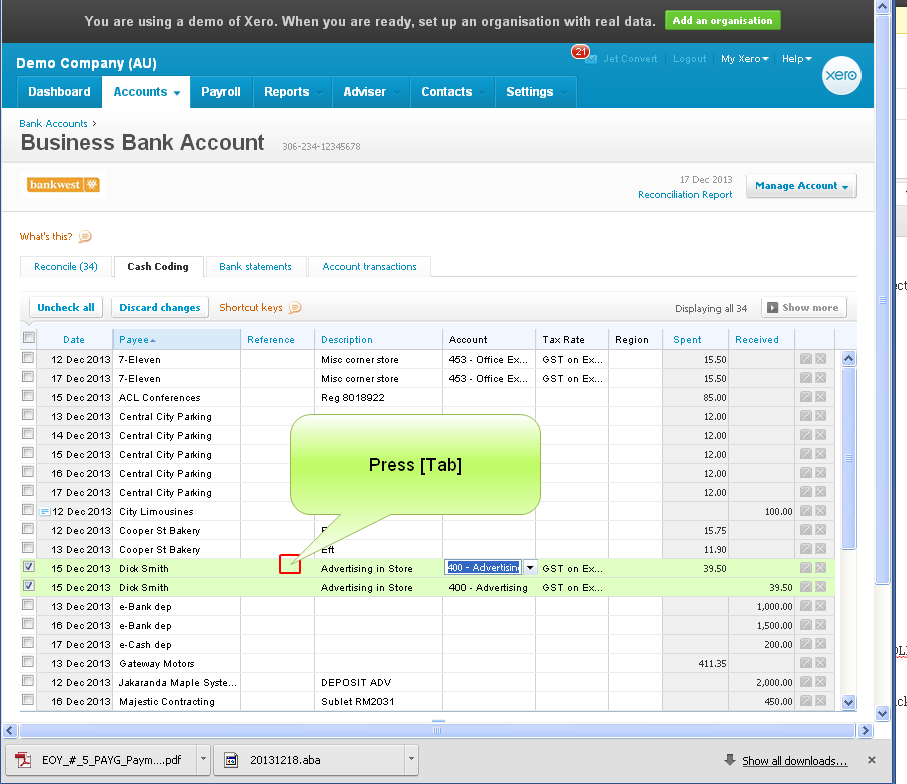

2. Choose “Cash Coding”. Click the top of the column to sort the “like” transactions together.

3. Tick the first group of items to be entered with the same details, then choose or type the details for the first entry. Note that all ticked items will have the same details.

4. Untick these items.

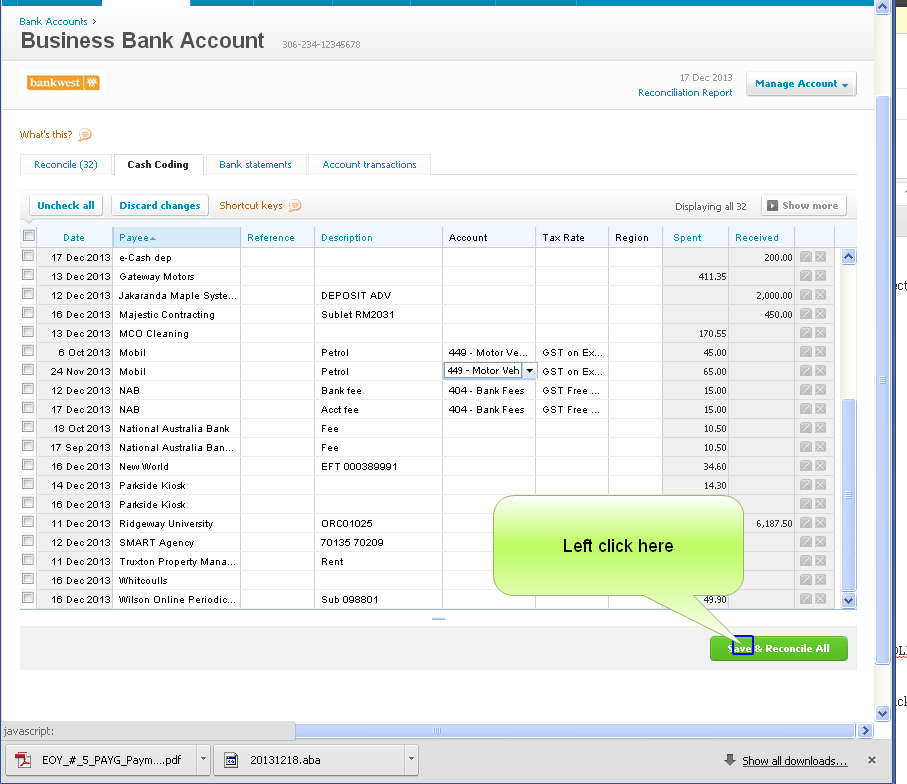

5. Then tick the second group of transactions which will have the same account details. Type the details and all the transactions will have the same details. Repeat the unticking, and ticking of each group, followed by the entry of repetitive details.

6. When all transactions are coded, be sure to UNTICK the transactions, otherwise they will all be coded to the last details.

7. Finally Click the “Save & Reconcile” button at the bottom of the screen.

Rules in Xero

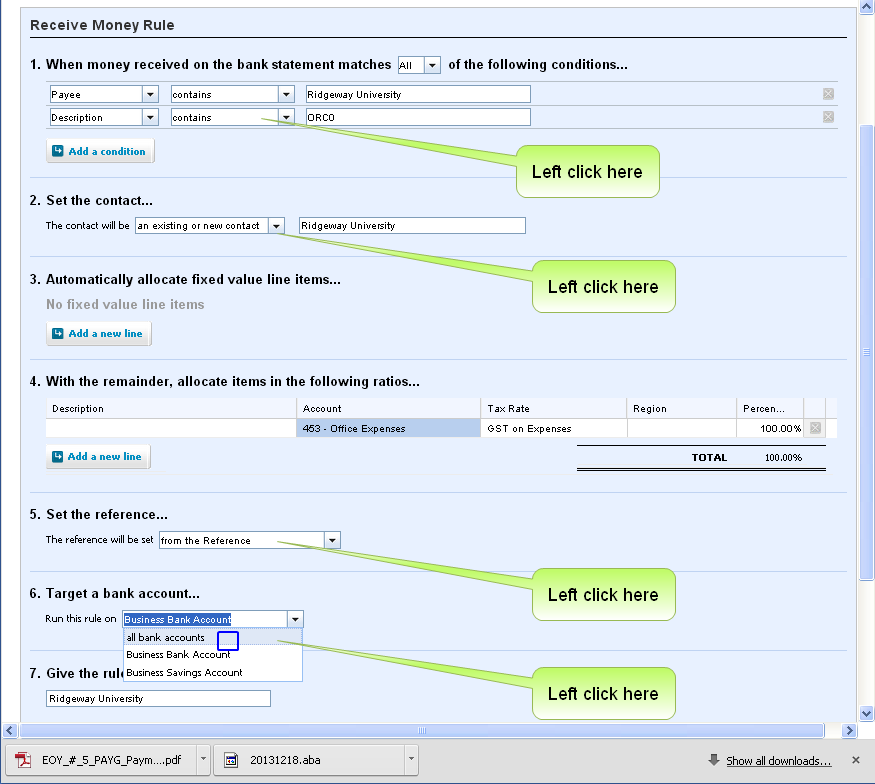

There are four short tips with Rules :

- Change the Condition from “equals” to “contains”

- Change the Payee to “an existing or new”

- Change the Reference to “from the Reference”

- Change the bank account to “all bank accounts”

Reconcile the Xero Payroll with the Bank Account

Xero recommends a payrun is saved as a bill, which is then reconcilled against the bank transactions. There is a great advantage to saving the payrun as an ABA file, as the amount at bank will equal the payrun bill.

If, however, you do not use an ABA file and pay your employees individually, then the transactions at the bank will be lots of small amounts which will collectively add up to the total payrun. To reconcile small, indivual transactions against the single bill, proceed as follows:

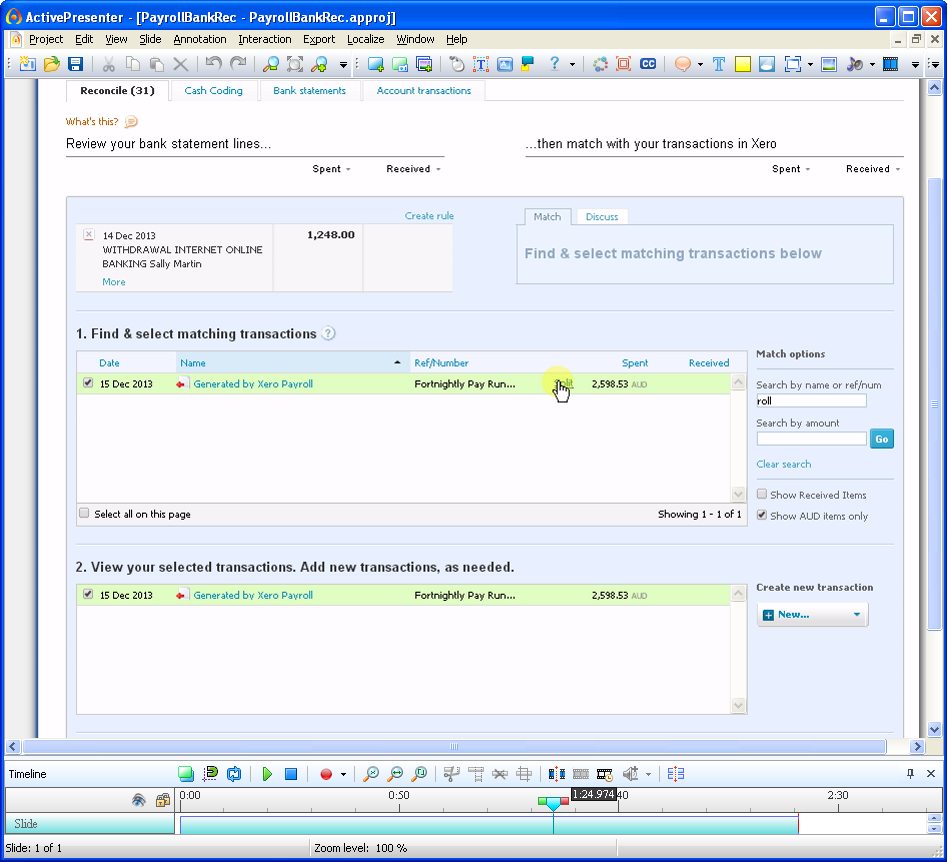

- Click Reconcile

- Click “Find and Match” on the individual person’s payment amount.

- Select the dollar amount then right click and choose copy, or press Ctrl+C.

- Click the textbox and type “roll” to find all the Bills for PayROLL. Press Enter.

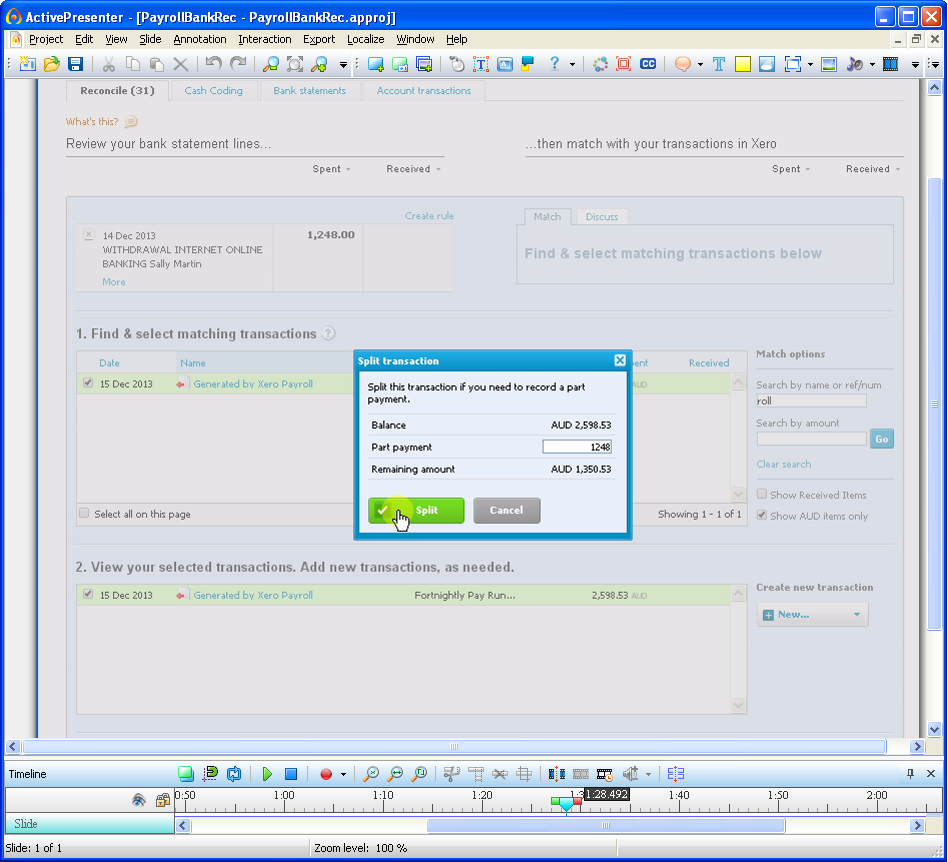

- Click the Bill to select it, then click the “SPLIT” button which only appears after ticking the bill.

- Paste with Ctrl+V, or right click, the amount previously copied.

- Click “Split” then click “OK”.

I hope you find some of these tips useful. If you have any time saving tips of your own that you’d like to share we’d love you to add a comment.